The Benefits of an M&A Adviser

You, the business owner, are a risk taker that is accustomed to getting things done on

Read Further

Selling your small business is a significant life event. The process carries both financial and personal stakes. It represents the culmination of years of hard work, and often, it’s a victory to celebrate.

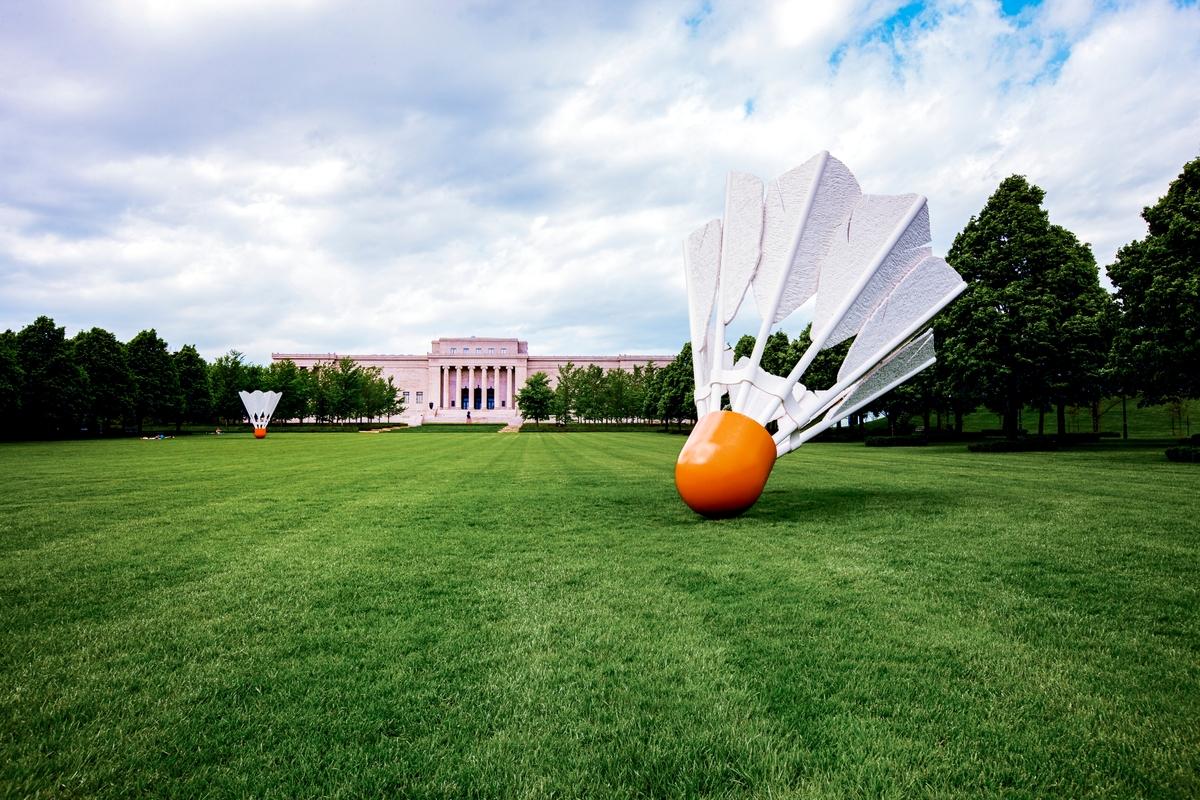

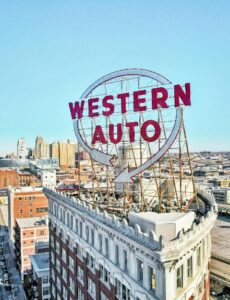

A profitable exit of your company can be complex, but with the right guidance, you will be able to handle it confidently. This guide provides a clear, step-by-step framework for owners who want to understand how to sell a small business in Kansas City and prepare for a successful transition.

At IBEX, we have worked with many business owners to successfully sell their Kansas City businesses through our industry expertise and knowledge of the local landscape. We understand the unique dynamics of the local market, and have established relationships with regional and national lenders, attorneys and tax professionals. Whether just exploring your options or are ready to move forward, understanding the sale process is essential for achieving your desired outcome.

Take the following steps to enhance the value of the sales process:

Selling a business isn't a single action but a series of distinct phases. Understanding the four major stages — preparation, marketing, negotiation, and closing — sets the foundation for a successful transaction. Each step requires careful thought and execution to protect your interests and maximize your return.

The process begins long before you take your business to market. Preparation involves getting your financial, operational, tax and personal affairs in order. Once you're prepped, the marketing stage begins, and, you or your broker will confidentially present the opportunity to potential buyers. This is followed by the negotiation phase, where you'll agree on price, terms, and structure. Finally, the closing stage involves legal due diligence and the legal transfer of ownership.

A small business sale is a more personal and nuanced process than a large corporate merger. The process of selling a small business in Kansas City often involves owner-operators, regional companies or family investment groups looking to expand their footprint, rather than large private equity firms.

Kansas City insight: Deals often involve owner-operators of similar businesses or regional buyers — not just large firms. With its location as a transportation (air, rail and waterway) hub and low-cost business environment, Kansas City is an attractive choice for regional businesses and family investors from Denver to Chicago to St. Louis. Southern Missouri is particularly rich in manufacturers looking to grow.

If you want to accelerate your deal, The preparation phase is critical when planning how to sell your Kansas City small business. A well-prepared business not only attracts more qualified buyers but also commands a higher sale price. Buyers value stable, well-run businesses with strong community ties. Your preparation should focus on three key areas: financial, operational, and personal readiness.

The first thing any serious buyer will examine is your financial records. Having clean, accurate, and verifiable financial statements for at least the past three years is therefore vital. Work with your accountant to create a process of timely, reliable financial reporting.

With reliable financials your broker can normalize earnings by adjusting for one-time expenses or discretionary owner perks. This process, known as recasting financials, provides a clear picture of the business's true profitability.

A business that depends too heavily on its owner is harder to sell. Start documenting your processes and, if possible, delegate key responsibilities to your team.

Creating repeatable, streamlined operations makes the business more attractive because it demonstrates that it can thrive under new ownership. Clear operational readiness reduces the perceived risk for a buyer.

Are you emotionally and financially ready sell? Clarifying your post-sale goals helps prepare you personally and shows potential buyers that you are forward-thinking. Whether you plan to retire, travel, or start a new venture, having a clear vision will help you stay focused on the victory and reward of selling your business, and remain objective during negotiations. Understanding your own motivations is a vital part of the journey. Remember this is the victory, the reward for all those late nights and quarterly tax filings.

Kansas City insight: Kansas City has a tightly networked and relationship-driven business community, so word-of-mouth and local reputation play a critical role in attracting qualified leads. Buyers on Kansas City are likely to look for a business with a strong involvement in the local economy. You can showcase this through Commerce membership, community sponsorships, or partnerships with other Kansas City companies.

Understanding what your business is worth is fundamental to a successful sale. An accurate valuation sets your deal on the right terms, gives you leverage in negotiations, and helps accurately plan your financial future. A data-driven valuation is non-negotiable in a transaction where emotion may lead to an overvaluing of the business.

When considering how to sell your small business in Kansas City start with a valued based multiple of your Seller's Discretionary Earnings (SDE). SDE represents the total financial benefit a single full-time owner-operator derives from the business annually. It is calculated by taking net income and adding back interest, taxes, depreciation, amortization, owner's salary, and other discretionary expenses. This figure is then multiplied by a market-based number that varies by industry, company size, and risk factors.

A valuation is an estimate rather than a guarantee. Set a realistic range, hope for the high end, and be prepared for offers that come in lower.

Kansas City insight: In Kansas City, buyers tend to value stability and reputation over hype. Businesses with steady earnings, long-term customers, and visible community involvement often sell faster and closer to their asking price. A broker who knows the local market can help you compare your numbers to recent sales in the metro area, and set a price that reflects what buyers here are really paying.

One of the most important decisions you will make is whether to hire a professional to guide you. Selling a business is a demanding and complex process. A broker acts as your advocate — managing the sale from start to finish, acting as your advocate throughout every stage, and bringing expertise you might not have in-house.

The benefits are numerous. Brokers have access to a network of pre-qualified buyers, which accelerates the search for the right fit. They handle the marketing confidentially, protecting your relationships with employees, customers, and suppliers. Brokers also bring negotiation expertise to the table, helping you secure the best possible price and terms. Perhaps most importantly, a broker manages the entire workload, allowing you to stay focused on running your business.

The best outcomes when selling your small business in Kansas City come with hiring a broker. Brokers bring an added advantage — deep knowledge of the regional market, relationships with local lenders and attorneys, and an understanding of what buyers in this area are looking for.

Once your company is properly prepared and valued, it's time to go to market. The challenge is finding qualified buyers without alerting your employees, customers, or competitors. A breach of confidentiality can disrupt operations and erode trust and value, so caution is essential. Effective marketing for a business sale involves several key tactics:

Your broker will create a "blind profile" or "teaser" that describes the business (industry, location, and key financial metrics) without revealing its name. This summary is used in online listings and initial outreach to gauge interest.

Serious prospects are required to sign a non-disclosure agreement (NDA) before receiving any identifying information. They are also financially screened to ensure they have the capacity to complete a purchase. This prevents you from wasting time with unqualified individuals.

One of the best marketing approaches, in combination with broad public advertising, is targeted outreach. Brokers tap into their existing networks of buyers, including private equity groups, strategic corporate buyers, and high-net-worth individuals who have expressed interest in acquiring a business like yours.

Additionally, a broker should have the tools and reach to connect with buyers outside their personal networks. The best targets for selling a small business in Kansas City might be a close-knit circle, but you want every possible buyer to be exposed to your business. Established relationships and targeted outreach are often more effective than regional ad campaigns, and these strategies ensure that your intent to sell remains private while still reaching potential buyers.

Receiving an offer is an exciting milestone — but it’s only the start of negotiations. A successful negotiation will balance your financial goals with the buyer's need for a fair deal, creating a win-win outcome.

Common negotiation points to consider include:

SBA loans are a primary source of financing for small business sales in Kansas City.. These local community banks have specific requirements, and their involvement can shape the deal structure. A broker who is experienced in the Kansas City market will help you navigate these points. You’ll likelyarrive at an agreement that maximizes your cash at closing and protects your long-term interests.

After you and the buyer agree on the terms and sign a Letter of Intent (LOI), the due diligence period begins. This is where the buyer conducts an in-depth look at your business to ensure they are getting what they are paying for.

After you and the buyer agree on the terms and sign a Letter of Intent (LOI), the due diligence period begins. This is where the buyer conducts an in-depth look at your business to ensure they are getting what they are paying for.

Preparing for due diligence is key to keeping the deal on track and preventing last-minute derailment. Honesty is critical. If there are any issues, it is better to disclose them upfront. During the closing phase, you'll be asked to provide a range of documents, including:

This phase can be detailed and demanding, but it’s also where progress happens. Remember, you have the knowledge about the business and the buyer has the resources. The more clearly and openly you share information, the closer you move toward a successful sale.

Once the buyer completes due diligence to their satisfaction, attorneys for both sides will draft the definitive purchase agreement. This is where you formalize all the representations you have made about the business and assure full transparency. . The definitive purchase agreement is binding, making it critical to have a good transaction attorney.

The closing is the final step, where all documents are signed, funds are transferred, and ownership of the business officially changes hands. For small businesses sold in Kansas City, timelines for this stage can be influenced by the approval processes of local lenders and the SBA.

The path to selling a business is filled with important decisions, learning opportunities, and moments that challenge you to think strategically. Avoiding these common mistakes can be the difference between a smooth, profitable sale and a frustrating attempt.

While every deal is unique, selling a small business in Kansas City typically takes nine to sixteen months from the initial listing to the final closing. The timeline can be influenced by factors like the industry, the preparedness of your financial records, buyer demand, and the financing process, especially if it involves local community banks or SBA loans.

Confidentiality is crucial when you're figuring out how to sell a small business in Kansas City. We have a proven process to protect your privacy. This includes using blind profiles in marketing, requiring all prospective buyers to sign a strict Non-Disclosure Agreement (NDA), and vetting them financially before sharing any identifying details. This ensures your employees, customers, and competitors remain unaware until the deal is complete.

The primary cost is the business broker's commission, which is a success-based fee paid only when the business is successfully sold. This fee is a percentage of the final sale price. Other potential costs include fees for your attorney and CPA to provide legal and tax advice during the transaction.

Yes, you can sell your business on your own, but it is a complex, time-consuming process that carries significant risks. Owners who go it alone are responsible for valuation, confidential marketing, buyer vetting, negotiations, and managing the due diligence process, all while still running their company. Using a broker typically results in a higher sale price and a smoother transaction.

Successfully navigating your small business sale in Kansas City is a marathon, not a sprint. It demands careful preparation, a realistic valuation, and flawless execution from marketing through closing. Every step you take today to professionalize your operations, clean up your finances, and define your personal goals will pay dividends when it's time to sell.

Successfully navigating your small business sale in Kansas City is a marathon, not a sprint. It demands careful preparation, a realistic valuation, and flawless execution from marketing through closing. Every step you take today to professionalize your operations, clean up your finances, and define your personal goals will pay dividends when it's time to sell.

The right strategy and expert guidance can mean the difference between simply closing a deal and achieving a truly profitable exit that honors your years of hard work. By planning early and working with trusted advisors, you can confidently take the next step toward your future.

If you’re ready to explore selling your business, connect directly with IBEX. Our team offers confidential, no-cost consultations to help Kansas City owners move forward. Contact us today to get started.

You, the business owner, are a risk taker that is accustomed to getting things done on

Read FurtherYou’ve found the buyer, negotiated a mutually rewarding deal, and are ready to close. Then it

Read FurtherEveryone asks, “What is my business worth?” An important question in determining whether you are ready to

Read Further