The Benefits of an M&A Adviser

You, the business owner, are a risk taker that is accustomed to getting things done on

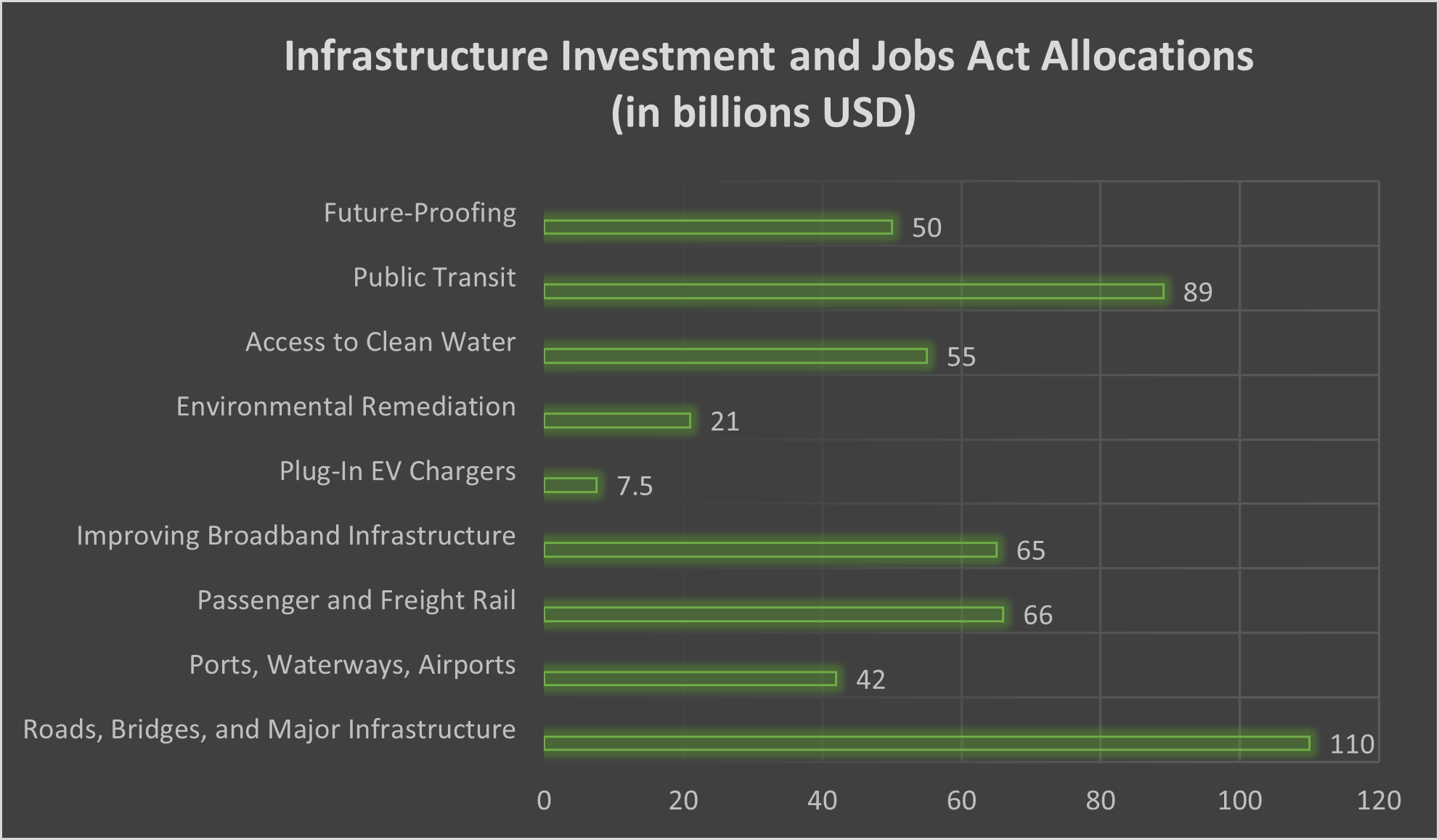

Read FurtherOn November 15, 2021, President Biden signed the bipartisan Infrastructure Investment and Jobs Act (IIJA). This law (PL 117-58) represents the largest public investment in American infrastructure in at least a generation and will generate multiple opportunities for the construction sector. The result of extensive negotiations on Capitol Hill, the IIJA allocates $1.2 trillion in total spending, including $550 billion above what Congress had already intended to authorize over the next five years. This money will fund extensive improvements to the electrical grid, expand access to clean water, rebuild America’s bridges and roads, improve access to public transportation options, reclaim abandoned mines, clean up Superfund and brownfield sites, and upgrade the country’s ports and airports. The law contains tax incentives to encourage public-private partnerships and private investment. The law also prioritizes future-proofing American infrastructure against extreme weather events, cyber-attacks, and climate change. Table 1 provides an overview of key categories for IIJA expenditures:

Table 1

Source: The White Houseiii

Overall, the additional allocation of $550 billion is equal to approximately 2.5% of United States GDP. This translates into an annual 7% (estimated) funding boost for the construction industry over the next five years, focused primarily on the non-residential sector. While not every dollar in the IIJA represents pure construction spending, this investment is historically significant and opens extraordinary opportunities for the industry. New public and private investment should propel growth in the US non-residential construction sector over the next five years.

One sector of the market that is poised for significant growth is modular and prefab construction. Modular buildings can be either permanent or relocatable and offer advantages such as less waste, fewer on-site accidents, and longer life spans. While the sector currently comprises only a small portion of the $1 trillion construction industry, Grand View Research estimates that the global modular construction market will grow by a compound annual growth rate (CAGR) of 6.4% between 2021 – 2030.iv Modular construction appeals to local and state governments looking for cost-effective ways to revitalize urban centers and address problems such as punitively high rent and homelessness. For example, the New York Department of Housing Preservation and Development recently commissioned the firm Think! Architecture and Design to construct a 167-unit modular housing block in Brooklyn. The residential units will range in size from studios to four-bedroom options and the facility will also include a community area, medical clinic, and support services for the homeless.v Despite its potential, the prefab industry has not been spared the effects of the COVID-19 pandemic. The AC Hotel New York NoMad (Danny Forster & Architects), a modular design of 26 stories, had to halt production in 2020 and the future of the project remains unclear.vi However, modular construction remains likely to grow as a sector of the industry. In addition to economic efficiencies and other advantages, modular projects offer the post-pandemic environment methods to better regulate employee safety in climate-controlled, ventilated environments, making them ideal for social distancing practices and rapid transitions in operations due to new covid variants.

One sector of the market that is poised for significant growth is modular and prefab construction. Modular buildings can be either permanent or relocatable and offer advantages such as less waste, fewer on-site accidents, and longer life spans. While the sector currently comprises only a small portion of the $1 trillion construction industry, Grand View Research estimates that the global modular construction market will grow by a compound annual growth rate (CAGR) of 6.4% between 2021 – 2030.iv Modular construction appeals to local and state governments looking for cost-effective ways to revitalize urban centers and address problems such as punitively high rent and homelessness. For example, the New York Department of Housing Preservation and Development recently commissioned the firm Think! Architecture and Design to construct a 167-unit modular housing block in Brooklyn. The residential units will range in size from studios to four-bedroom options and the facility will also include a community area, medical clinic, and support services for the homeless.v Despite its potential, the prefab industry has not been spared the effects of the COVID-19 pandemic. The AC Hotel New York NoMad (Danny Forster & Architects), a modular design of 26 stories, had to halt production in 2020 and the future of the project remains unclear.vi However, modular construction remains likely to grow as a sector of the industry. In addition to economic efficiencies and other advantages, modular projects offer the post-pandemic environment methods to better regulate employee safety in climate-controlled, ventilated environments, making them ideal for social distancing practices and rapid transitions in operations due to new covid variants.

Construction is the largest industry in the world, equivalent to approximately 13% of global GDP. Yet the industry consistently underperforms due to low productivity, risk aversion, and lagging uptake of digital technologies. Profitability hovers around a 5% EBIT margin.vii Digitization promises to realize significant gains in productivity, profitability, and customer satisfaction. The new paradigm of “connected construction” is especially promising. Autodesk University defines connected construction, at its core, as “open communication between technology to make sure that project teams have the right information at the right time, leading to better project outcomes.”viii Connected construction draws upon a suite of disruptive technological tools such as augmented reality/virtual reality (AR/VR), computer vision, and real-time data analytics. In its report Winning with Connected Construction, Deloitte concludes that “connected construction is a solution that has the potential to help improve project planning and execution efficiencies as well as margins. By harnessing the data from the digitally enabled built assets, homes, offices, and, in turn, cities can all be operated in a smarter, more efficient, and useful way.”ix Harnessing the power of digital and experiential technologies (such as AR and VR) via connected construction framework will unlock significant new value streams and generate additional opportunities for innovation in an era of smart cities and smart infrastructure. Connected workflows will breakdown data siloes, streamline information access, and eliminate data loss.x

Green Infrastructure

Green InfrastructureThe construction industry is essential to human well-being and resilience. However, the U.S. Green Building Council (USGBC) estimates that the construction industry accounts for 40% of global energy usage and emissions from commercial buildings will grow by 1.8% to 2030.xi In an era characterized by intense public concern about climate change and greenhouse gas emissions, reducing construction’s environmental footprint is imperative. As Dr. Faith Birol, Executive Director of the International Energy Agency, argues, “if we don’t make buildings more efficient, their rising energy use will impact all of us, whether it be through access to affordable energy services, poor air quality, or higher energy bills.”xii Without a concerted effort to embrace innovation, the industry could also see the escalation of regulatory reviews, public controversies, and coordinated activist resistance to normal operations. Green infrastructure provides a promising pathway to addressing some of these challenges. The United States Water Infrastructure Improvement Act (2019) defines green infrastructure as “the range of measures that use plant or soil systems, permeable pavement or other permeable surfaces or substrates, stormwater harvest and reuse, or landscaping to store, infiltrate, or evapotranspirate stormwater and reduce flows to sewer systems or to surface waters.”xiii Green infrastructure could also be financially rewarding. The firm Coherent Market Insights estimates that the global green construction market size, valued at US$ 265.7 billion in 2020, will reach US$ 602.1 billion by 2028 at a CAGR of 11.4%.xiv

The United States is trying to scale electrical vehicle (EV) charging capacity on top of an aging power grid that is vulnerable to power outages, overheating, and security breaches. For example, data from the Energy Information Agency shows that the average US household consumes approximately 1 KW of energy per hour (or 900 kWh hours per month). By comparison, some brands of EV superchargers churn through 24 KW, while the Tesla supercharger tops out at 120 KW. It will be essential to reduce the pressure on the grid as EVs become mainstream. The Biden Administration has set a target of building a network of 500,000 EV charging stations across the United States by 2030. The Infrastructure Investment and Jobs Act invests in a long-overdue upgrade of the electricity grid, but the process will take years. The cybersecurity risks of EVs and charging stations are also catching the attention of national security experts and the insurance industry. Electric vehicles are essentially big, mobile computers, which means that hackers could cause dangerous malfunctions that spread from the driver to encompass passengers, pedestrians, and infrastructure. For example, a hacker—either professional or potentially a troll—could “power jack” EV chargers, resulting in blackouts and compromised data. Lest this seems far-fetched, a benevolent hacker in Germany, David Colombo (who shared his findings with authorities), found a remote-control security flaw in a third-party app installed in a Teslaxv that allowed him to interfere with windows and lights at a distance. Sandia National Laboratories contends that “cyberattacks on vehicle charging could impact nearly all of U.S. critical infrastructure.”xvi To confront this growing risk, the Department of Defense requires that requests for proposals pertaining to EV charging initiatives include strong cybersecurity plans/awareness. Given that electrical contractors in the home and public charging markets may not have prior cybersecurity training or experience, industry leaders will need to ensure upskilling to include these concerns become a normal aspect of training, development, and installation. While these are significant challenges, the construction industry stands to benefit from increased awareness of and investment in cybersecurity. As Boreworx argues, “the construction industry is a key player that is well-positioned to take on this challenge. They have the technology to install EV stations with minimal disruption. With horizontal directional drilling, trenches are eliminated, which allows for the construction of EV chargers where they are needed most: high traffic areas.”xvii

The uptake of electric vehicles, and the associated need for a reliable charging network across the United States will also propel opportunities in the construction industry. The electrical vehicle (EV) charging station market includes two main segments: home charging and public charging. Because the charger is built into the EV, home charging requires installation of electric vehicle service equipment (EVSE).xviii Public charging refers broadly to the refueling infrastructure needed for EV fleets and passenger cars to be driven over distances with the same reliability and convenience as gas-powered cars. According to the US Department of Energy, the ideal ratio of EVs to charging stations is 40 Level 2 charging ports and 3.4 DC fast chargers (DCFC) per 1,000 EVs.xix Market analysts are bullish on the overall prospects for the development of the global EV charging station network. The global charging industry reached 17.59 billion USD in 2021. This was a significant decline relative to the period 2017 – 2019 that can be attributed primarily to the shock of the covid-19 pandemic. As the health crises eases, renewed momentum for EV sales, and hence demand for charging stations, seems poised to climb. Fortune Business Insights, for example, estimates that the global charging market will grow to $111.90 billion in 2028 at a compound annual growth rate (CAGR) of 30.26%.xx Research and Markets projects a compound annual growth rate (CAGR) of 44.1 percent in global EV charging stations, increasing from 2,354 units in 2022 to 14,623 units by 2027.xxi

Inflation

InflationOn March 10, 2022, the United States Bureau of Labor Statistics reported that the consumer price index for all urban consumers (CPI-U) increased 7.9% (before seasonal adjustment) over the previous twelve months. This is the largest twelve month change since the period ending August 1982. Gasoline, shelter, and food prices rose the most.xxii These data predate the Russian invasion of the Ukraine on February 24, 2022—an event that exacerbated the inflationary spiral. Many experts initially expressed hope in late 2021 that inflation would be transitory. However, Federal Reserve Chairman Jerome Powell believes that the “factors pushing inflation upward will linger well into next year.”xxiii On May 4, 2022, the Federal Reserve increased the baseline interest rate by 0.5%, the largest increase since 2000. The construction industry has been hard hit by inflation. The Government’s Producer Price Index for construction climbed 22% in 2021. Fabricated structural materials increased by 42%, iron and steel by 87%, and steel mill products by 127%. In December 2021, softwood lumber prices rose 24 percent.xxiv

Bottlenecks in the global supply chain are a significant challenge for the construction industry and could further escalate inflation pressure. Daniel Worm, Uponor North America Commercial Segment Manager, believes that “our primary concern going into 2022 is the ongoing supply and distribution constraints facing the marketplace.”xxv In November 2021, 90% of the builders surveyed by housing market research firm Zonda acknowledged that supply chain disruptions posed a problem, compared to 75% of respondents the year before.xxvi The Allianz Risk Barometer 2022, a global survey of industry professionals that included 160 respondents from the construction industry, shows that supply chain issues and operational disruptions are the top concerns across the globe.xxvii In Australia, the number of construction companies filing for insolvency increased by 22% from March 2021 to March 2022, while mortgage arrears among sole traders were twice that of the average consumer. Scott Mason, General Manager (Commercial Property and Services, Equifax), argues that “rising costs, disrupted supply chains and periodic lockdowns have created a ‘profitless boom,’ with many construction companies committed to projects that are no longer financially viable thanks to major price increases for building materials.”xxviii Amazon’s relentless expansion has also put extraordinary pressure on global supply chains. The rapid increase in online shopping, driven by the pandemic, largely benefited Amazon, which accounted for approximately 60% of online purchases in 2021. This boom fueled further expansion of Amazon’s warehouse capacity, which is expected to reach 457.3 million square feet by the end of 2022.xxix The real-world response McRight-Smith Construction, “Sorry, I can’t help you, Amazon has bought everything in production for the next six months” succinctly captures the reality of the Amazon Effect on the construction industry.xxx

Worker Availability

Worker AvailabilityAn AGC survey of 937 construction industry professionals found that 73% of respondents are concerned about worker shortages. This is the fourth highest ranked concerned, following material costs (86%), availability/supply chain disruptions (79%), and the continuing impact of the pandemic on projects, workers, or the supply chain (79%).xxxi The number of construction job openings reached 410,000 in October 2021, the highest level since 2000. Wells Fargo Media emphasizes that “shortfalls of labor are widespread across the trades but appear most acute for skilled positions that require technical knowledge, extensive training, or certifications.”xxxii A McKinsey & Co. study suggests that the Infrastructure Investment and Jobs Act could create 3.2 million new jobs across the nonresidential construction value chain, a 30% increase that would translate into 300,000 to 600,000 new workers per year.xxxiii While an exciting prospect, such intensive job growth will require the construction industry to seek out and support employees from nontraditional backgrounds, ensure that corporate culture supports diversity and inclusion, and provide educational and training opportunities to employees across the career span. Leveraging digital technologies and robotics to increase productivity will also be essential.

Owning a business is not for the faint-hearted. Owners have spend decades building the business and creating value, and employees and family members have a significant stake in the outcomes of their decisions. We believe the two most significant factors driving buyer interest in construction at this juncture are: 1) the projected growth of the industry in the post-covid-19 recovery phase; and 2) the extraordinary opportunities embedded in the Infrastructure Investment and Jobs Act (IIJA). We also see excellent opportunities in the following industry sectors:

Considering the extraordinary opportunities available in the construction industry today, owners of construction businesses owe it to themselves and their stakeholders to take a serious look at the option to exit. The decision is personal and challenging, and there is no one-size-fits-all answer. We are ready to work with you to analyze these opportunities and develop a forward-looking strategy that suits your goals and business.

[i] Preparing Your Family-Owned Business for Sale? | Kiplinger [ii] The Next Normal: Business Trends for 2021 | McKinsey [iii] Fact Sheet: The Bipartisan Infrastructure Deal | The White House [iv] Modular Construction Market Size & Share Report, 2028 (grandviewresearch.com) [v] City Announces Modular Affordable Housing Development at 581 Grant Avenue in East New York – New York YIMBY [vi] Modular AC Hotel Nomad | Danny Forster & Architecture and A Supertall Modular Hotel Is Going Up in Manhattan, if the Rooms Ever Leave Brooklyn – WSJ [vii] executive-summary_the-next-normal-in-construction.pdf (mckinsey.com)

[viii] 5 Benefits of Connected Construction for Better Project Outcomes (autodesk.com)

[x] 5 Benefits of Connected Construction for Better Project Outcomes (autodesk.com)

[xi] How Does Construction Impact the Environment? | GoContractor

[xii] Environmental Impact of Construction Addressed by Global Builders (boldbusiness.com)

[xiii] https://www.epa.gov/green-infrastructure/what-green-infrastructure

[xiv] https://www.digitaljournal.com/pr/green-construction-market-is-expected-to-benefit-from-an-increase-in-infrastructure-projects-in-the-industrial-and-commercial-sectors-alumasc-group-plc-bauder-ltd-clark-group-hensel-phelps

[xv] Tesla security flaw: Teen hacker says he took control of 25 Teslas | Fortune

[xvi] Plant Engineering | Considering electric vehicle charging risks

[xvii] https://www.boreworx.com/blog/what-the-future-of-the-construction-industry-looks-like-with-an-expansion-of-ev-charging-stations

[xviii] 5 Things That Could Slow Your EV’s Home Charging Speeds | News | Cars.com

[xix] National Plug-In Electric Vehicle Infrastructure Analysis (energy.gov)

[xx] https://www.fortunebusinessinsights.com/electric-vehicle-ev-charging-stations-market-102058

[xxi] Electric Vehicle Charging Station Market – Global Forecast (globenewswire.com)

[xxii] Consumer Price Index Summary – 2022 M02 Results (bls.gov)

[xxiii] Why U.S. officials say inflation is no longer ‘transitory’ | Fortune

[xxiv] Inflation, material delays, labor issues: Pros face a trifecta of pricing woes | Construction Dive

[xxvi] Supply-Chain Issues Leave New Homes Without Garage Doors and Gutters – WSJ

[xxvii] Top Concerns of Construction Contractors in 2022 | For Construction Pros

[xxix] Amazon makes name as a disruptor— but not in a good way (therealdeal.com)

[xxxi] Contractors, dealers are optimistic about 2022 forecast | Equipment World

[xxxii] 2022 Construction Industry Forecast (wellsfargomedia.com)

[xxxiii] Solving US construction’s worker shortage | McKinsey

Prior to purchasing IBEX, Chuck Harvey spent 35 years as CEO, CFO and consultant to the Fortune 500, Middle Market, Mainstreet and in the Start-up community, including spending time at PepsiCo & Price Waterhouse Coopers. During that time, Chuck oversaw three dozen buy-side / sell-side transactions on three continents, including a $35M sale of a Texas digital photography pioneer to a $1 Billion Japanese conglomerate.

Photo: bbb low-cost housing, prototype

Photographer: seier+seier

Licenses: Attribution 2.0 Generic

Photo: Downtown Landscape

Photographer: Kay Ellen

Licenses: Attribution 2.0 Generic

Photo: Workers

Photographer: Michael Newman

Licenses: Attribution 2.0 Generic

“Texas Real Estate Commission Information About Brokerage Service”,

“Texas Real Estate Commission Consumer Protection Notice.”