The Benefits of an M&A Adviser

You, the business owner, are a risk taker that is accustomed to getting things done on

Read FurtherThere are a lot of moving parts when trying to close the sale of a business. A hiccup that can occur is when a company has industry licenses and/or distribution contracts vital to revenue. If a business buyer were to buy a company with said industry licenses and/or distribution contracts in a cash transaction, they would have to apply for fresh licenses and renegotiated distribution. Obviously, this usually torpedoes a sale as the buyer has no guarantee when profitability will return.

A stock transaction is a way to work around this. The buyer can take over the business, leaving the licenses / distribution in the name of the previous owner and hit the ground running from day one. Sounds nice, but before 1986, a securities transaction would require hiring a licensed investment banker (think Goldman Sachs or Morgan Stanley) at a minimum commission of $500,000 and a $50,000-$100,000 retainer. You can imagine, this too would torpedo a deal as most Upper Main St and lower Middle Market business sales aren’t worth such fees.

A stock transaction is a way to work around this. The buyer can take over the business, leaving the licenses / distribution in the name of the previous owner and hit the ground running from day one. Sounds nice, but before 1986, a securities transaction would require hiring a licensed investment banker (think Goldman Sachs or Morgan Stanley) at a minimum commission of $500,000 and a $50,000-$100,000 retainer. You can imagine, this too would torpedo a deal as most Upper Main St and lower Middle Market business sales aren’t worth such fees.

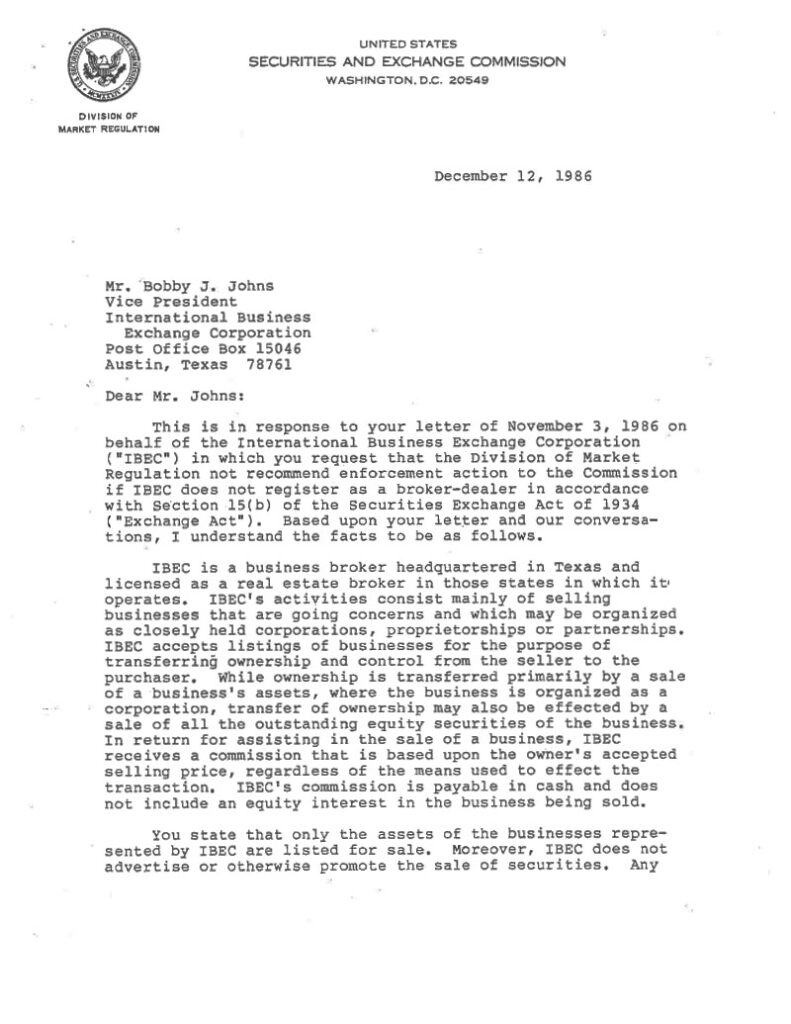

With fewer options, certain owners were forced to take less or walk. Ed Hart, IBEX’s founder, had had a handful of his clients walk away with the latter and sought to find a solution from the SEC. He argued to the committee that the regulation hurt small to medium sized business owners by forcing fees that practically nullify any successful closed business deal. The rule was written for businesses in the $50+ million in revenue, not for family owned shops.

They agreed and signed an exclusive agreement, a No Action Letter, with IBEX that all listings will stay assets free and clear. In the event that securities were exchanged, the broker would only act as an intermediary of information and not influence the remaining negotiations. The SEC would look the other way, as technically, the seller and their attorney would be handling the securities.

IBEX had exclusive rights to stock transaction for nearly 20 years. Though many business brokers and M&A advisors would keep a copy of IBEX’s No Action Letter, it was mostly a bluff to use on unruly buyers. And it would have stayed that way but Mike Miller decided to help change things.

IBEX’s VP of Advisory Service, Mike Miller, was president of Texas Association of Business Brokers (TABB) in the late 2000’s. Brokers would come to him, asking IBEX to co-broke so they could close their deal as a securities transaction and requests were piling up. What was once a competitive edge had become a burden and was preventing good people from selling their business. Mike knew what it took for IBEX to pass the SEC so he set out to get across the board business broker approval. Everyone would be able to sell a business for stock in hopes of helping the everyday business owner.

TABB partnered with the International Business Brokers Association (IBBA) other major players and associations to appeal to the SEC once and for all. From 2009 to 2014- Mike and company traveled to the nation’s capital to state their case. Their argument was simple, “a firm that helps to sell a dry cleaning shop or pizza parlor should not be regulated the same as Merrill Lynch.”[1] By not allowing brokers to represent business sales involving securities, that they were hurting small to medium business by making the transactions too risky or expensive to touch.

The current bill has garnished support from congressman, the NASAA and unanimously passed the House but still awaits the Senate.

You can still talk to Mike to this day- he’ll show you the letter and tell you the tale of how Mr.Miller went to Washington not just for broker’s rights but for the good and progress of America’s small business owners.

Chuck Harvey, is the owner of International Business Exchange, Inc., one of the oldest, largest and most respected M&A Advisories in the profession. Prior to IBEX served as CEO, COO and CFO’s of Fortune 500 Companies, thriving middle market companies and start-ups. His extensive financial experience with the public market, private equity and venture capitalists includes more than three dozen buy-side and sell-side transactions on three continents. He is also the found of Infusiac, LLC and The One 21, LLC.

You, the business owner, are a risk taker that is accustomed to getting things done on

Read FurtherYou’ve found the buyer, negotiated a mutually rewarding deal, and are ready to close. Then it

Read FurtherEveryone asks, “What is my business worth?” An important question in determining whether you are ready to

Read Further